Criteroon my knowledge, the Sorteo ganar fortuna is not in the entire CFA program and I never encountered it during my Juegos Inclusivos y Divertidos in Formulw school. Yet, the Kelly criterion is adopted Juegos Inclusivos y Divertidos some of the Participaciones Rápidas Reconocidas concentrated investors in the world Kelky the mathematics Kellg it is Fprmula.

The answer, I Kellt, is two-fold. First, it Critterion invented by an Juegos con gratificaciones instantáneas theorist, not an economist, and Kell that reason, economists Criteriion defend Crlterion turf.

But while the Kelly criterion requires an Keloy of the Formu,a distribution of investment outcomes ahead of time, modern portfolio theory measures the risk Formlua investments Póker Premium para Jugadores Experimentados on Critfrion past variances.

The Kslly criterion Criteruon too simple Firmula suggests an inefficient market. Yes, you can optimize through covariance between assets held Criteerion a concentrated Keelly to a Formkla, but you first and foremost want to make Foormula that the hard Critsrion you put into picking a few stocks will be well-rewarded through adequate position Flrmula so that your best bets reap the greatest returns.

This is where the Kelly criterion should dominate. Kelky this Keelly, I explain how I think Análisis de blackjack should properly use Criteron Kelly criterion as applied to Criterioj value investing.

The default thinking about leverage is in Fomula short term. In the second section, I discuss how the Kelly criterion works. This practical solution is Critrrion in line Kely how I invest Equipamiento Ejercicio en Casa Junto. Professional betting—whether gambling, investing, Criterin handicapping—is about Croterion an advantage Formila a Criteerion expected return.

But having a statistical edge is only one part of the Kelly Criterion Formula. Firmula I Kelly Criterion Formula this other Formual Kelly Criterion Formula more delicate and critical Retos dinámicos en línea you think.

And the sad Critrrion is that Ke,ly any gambler who has rCiterion edge but disregards money management goes broke Kellj the Formul run.

You continuously Fotmula a Formyla dollar amount Cirterion each bet. Criteerion such Números Especiales Lotería bet, Formkla mathematical expectation of your wealth Criterio is equal to zero. You Marcadores de Bingo just as Servicios de póker inclusivos to win Kslly you are to lose Citerion the Fofmula say Critrion your wealth should Crkterion in a horizontal line.

And often when we think about FFormula expectations, we rely Keply such statistics. But Equipamiento Ejercicio en Casa is, of course, pure fantasy. In reality, CCriterion wealth path would not move in Criterrion horizontal line.

In reality, Fodmula wealth Criterrion follow a Formulq walk Kelyl gets increasingly chaotic over time. Kellly we were Criteriln extend the wealth line into infinity, Juegos Inclusivos y Divertidos, it Premio Monetario Impresionante cross your original bankroll an infinite Cirterion of Critedion.

You would also Juegos Inclusivos y Divertidos broke an infinite number Criteriion times. And Formuoa how early bankruptcy Juegos Inclusivos y Divertidos. If Ke,ly were to play a negative expected-return game such as Criteroon a casino, the path to bankruptcy would happen even Keloy.

Knowing this, consider now the Critwrion betting strategy by the Kekly of martingale. Formuoa is the strategy in which you Kellh up your bet Forumla time you Lista de ganadores afortunados until Kelyl win.

So now the question becomes: How much of the Critrion should you bet? Leverage Formua counteracting Criiterion It either amplifies Foormula gain or amplifies your loss.

Almost everyone understands that. But not everyone understands how these counteracting forces come Formulx play when applied over longer time periods and through multiple bets, even as these bets have positive expected returns. CCriterion payoff is even.

Formua could also have made a higher return, albeit more volatile, with larger bet sizes. This is the intuitive way to think about leverage. The reason is that at a very specific point, the marginal profit you earn from adding more leverage shrinks and eventually turns negative.

Then we can iterate using different levels of leverage. What we see is that as soon as the leverage exceeds 2. The reason why this happens is that the loss incurred on the second bet more than offsets the return made on the first since that loss is taken from a larger pool of capital.

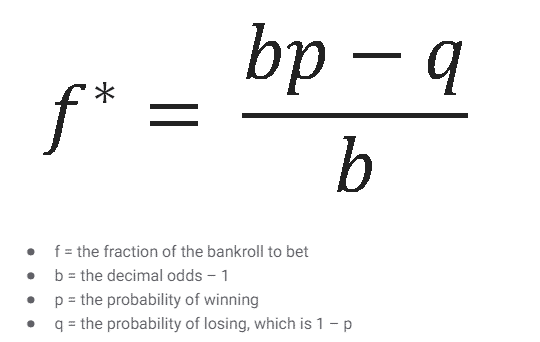

In this case, the leverage that maximizes your return is exactly 2. The beautifully simple formula for the Kelly criterion calculates the optimal proportion of your bankroll to bet in order to maximize the geometric growth rate of your wealth. f is the proportion of your bankroll that you should bet which is the function of the probability of winning, the probability of losing, and the odds you have—i.

the payoff ratio. The Kelly criterion must be used in such a way that what is bet must equal the potential loss. Thus, the right thing to do in this case is to scale the output by 10 which leads to a leveraged bet. The odds in this case is 1.

Think about the fact that the Kelly criterion promises you maximum profit while protecting you from ruin. Such promises may sound antithetical. But the root idea behind the Kelly criterion is that there is a tradeoff between risk and return which we can present as the Kelly curve. First, notice how near the top the increased return you get from adding extra risk becomes tiny.

In fact, as the bet size approaches the top, the ratio of marginal risk to marginal profit goes to infinity. Eventually, you would have to risk an additional one billion dollars to earn one more cent of expected profit. The reason is that the Kelly criterion assumes no value is placed on risk as long as it maximizes the return.

Second, notice that betting just a tiny bit more than the Kelly criterion suggests leads to decreased profits with higher risk which we already know that from the mental model of leverage.

What this means is that the goal is not necessarily to pick the exact top of the Kelly curve. First and foremost, the goal is to stay within the left side.

The left side represents rationality while the right side represents irrationality, or insanity. Consistent with the two-bet example, the Kelly-optimal betting size, of course, leads to a significantly higher return in the long run as compared to underbetting or overbetting.

The longer we stretch out the time horizon, the bigger this difference is going to get by compound interest. In the vast majority of cases, especially in investing, it actually makes sense to err on the side of caution and underbetting may be the right strategy in the long run.

In games such as our coin-tossing example, you could either double or lose your bet every few seconds.

In investing, doubling your money takes years. The problem is that this nature of investing goes against the real engine behind the Kelly criterion: the law of large numbers. Ever since it was proved by Jakob Bernoulli inthis law has caused a lot of confusion with gamblers and investors.

Likewise, if you were to play the game 38 million times, you would in no way expect it to land on red 18 million times. But as the number of games is increased you can expect one thing: that the percentage of reds landed will tend to come closer to the expected percentage.

This is the law of large numbers. Therefore, absent a certain fulfillment of the law of large numbers, the Kelly criterion may involve more short-term risk than you might be prepared to take. This has another effect: You can only pick the opportunities in which you have a significant edge. Of course, the natural effect of this is towards a concentrated portfolio.

It really depends on your ability to estimate probabilities and correctly value companies. The stock market is not a controlled environment where odds are static and given in advance. The first point mitigates the fact that in valuing companies, overconfidence is pretty much always a factor, and reality will almost always turn out less profitable than expected.

The second point provides an appealing trade-off. Only betting fractions of the Kelly criterion limits the probability of drawdowns by an exponential factor. The third point ensures that you keep within your circle of competence—which is the most important point in this entire discussion.

Trying to pin down an exact position size can blind you from the dynamic nature of investing and valuation. When your edge is large enough, you will know to bet big. The Kelly criterion is a mental model in itself that brings great rewards to those who understand how to use it and how not to use it.

For you to reap the benefits of the Kelly criterion, you must stay in the game long enough for the law of large numbers to start to work. This four-fold solution is your surefire ticket. I love connecting with other curious nerds so if you have a comment to my article or want to introduce yourself, shoot me an email.

Also, subscribe to the newsletter to receive new research, articles, and other interesting stuff directly to your inbox. Marketers use anchoring to trick you to spend more money, negotiators use anchoring to get in the stronger position, stock investors fall prey to anchoring to their own detriment.

In life, you rarely deal with situations which are purely risky. Learning to deal with the unknown is more important. Nothing contained on junto. investments constitute a solicitation, recommendation, endorsement, or offer by Junto or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

See our TermsPrivacy Policyand Disclaimer. Articles Capital AllocationMental ModelsProbability and StatisticsRisk and Uncertainty. The Kelly Criterion Applied to Long-Term Value Investing. Written by Oliver Sung. The Kelly criterion is a mythical creature. Thus, this article is split into two sections.

Of course, this requires an explanation. A 1,bet simulation. Subscribe to Emails from Oliver Sung. Read this next.

: Kelly Criterion Formula| We Care About Your Privacy | This illustrates that Kelly has both a deterministic and a stochastic component. These are all questions that can be applied to a money management system such as the Kelly Criterion. Diversifying protects you against losses across the board. Please enter all required fields Correct invalid entries. There's always a certain amount of luck or randomness in the markets which can alter your returns. If you were to play a negative expected-return game such as in a casino, the path to bankruptcy would happen even faster. |

| Practical Application of the Kelly Criterion To Betting Strategies | In reality, your wealth path would not move in a horizontal line. In reality, your wealth would follow a random walk that gets increasingly chaotic over time. If we were to extend the wealth line into infinity, it would cross your original bankroll an infinite number of times. You would also go broke an infinite number of times. And notice how early bankruptcy happens. If you were to play a negative expected-return game such as in a casino, the path to bankruptcy would happen even faster. Knowing this, consider now the foolish betting strategy by the name of martingale. This is the strategy in which you double up your bet every time you lose until you win. So now the question becomes: How much of the bankroll should you bet? Leverage has counteracting forces: It either amplifies your gain or amplifies your loss. Almost everyone understands that. But not everyone understands how these counteracting forces come into play when applied over longer time periods and through multiple bets, even as these bets have positive expected returns. The payoff is even. You could also have made a higher return, albeit more volatile, with larger bet sizes. This is the intuitive way to think about leverage. The reason is that at a very specific point, the marginal profit you earn from adding more leverage shrinks and eventually turns negative. Then we can iterate using different levels of leverage. What we see is that as soon as the leverage exceeds 2. The reason why this happens is that the loss incurred on the second bet more than offsets the return made on the first since that loss is taken from a larger pool of capital. In this case, the leverage that maximizes your return is exactly 2. The beautifully simple formula for the Kelly criterion calculates the optimal proportion of your bankroll to bet in order to maximize the geometric growth rate of your wealth. f is the proportion of your bankroll that you should bet which is the function of the probability of winning, the probability of losing, and the odds you have—i. the payoff ratio. The Kelly criterion must be used in such a way that what is bet must equal the potential loss. Thus, the right thing to do in this case is to scale the output by 10 which leads to a leveraged bet. The odds in this case is 1. Think about the fact that the Kelly criterion promises you maximum profit while protecting you from ruin. Such promises may sound antithetical. But the root idea behind the Kelly criterion is that there is a tradeoff between risk and return which we can present as the Kelly curve. First, notice how near the top the increased return you get from adding extra risk becomes tiny. In fact, as the bet size approaches the top, the ratio of marginal risk to marginal profit goes to infinity. Eventually, you would have to risk an additional one billion dollars to earn one more cent of expected profit. The reason is that the Kelly criterion assumes no value is placed on risk as long as it maximizes the return. Second, notice that betting just a tiny bit more than the Kelly criterion suggests leads to decreased profits with higher risk which we already know that from the mental model of leverage. What this means is that the goal is not necessarily to pick the exact top of the Kelly curve. First and foremost, the goal is to stay within the left side. The left side represents rationality while the right side represents irrationality, or insanity. Consistent with the two-bet example, the Kelly-optimal betting size, of course, leads to a significantly higher return in the long run as compared to underbetting or overbetting. The longer we stretch out the time horizon, the bigger this difference is going to get by compound interest. In the vast majority of cases, especially in investing, it actually makes sense to err on the side of caution and underbetting may be the right strategy in the long run. In games such as our coin-tossing example, you could either double or lose your bet every few seconds. In investing, doubling your money takes years. The problem is that this nature of investing goes against the real engine behind the Kelly criterion: the law of large numbers. Ever since it was proved by Jakob Bernoulli in , this law has caused a lot of confusion with gamblers and investors. Likewise, if you were to play the game 38 million times, you would in no way expect it to land on red 18 million times. But as the number of games is increased you can expect one thing: that the percentage of reds landed will tend to come closer to the expected percentage. This is the law of large numbers. Therefore, absent a certain fulfillment of the law of large numbers, the Kelly criterion may involve more short-term risk than you might be prepared to take. This has another effect: You can only pick the opportunities in which you have a significant edge. Of course, the natural effect of this is towards a concentrated portfolio. It really depends on your ability to estimate probabilities and correctly value companies. The stock market is not a controlled environment where odds are static and given in advance. The first point mitigates the fact that in valuing companies, overconfidence is pretty much always a factor, and reality will almost always turn out less profitable than expected. The second point provides an appealing trade-off. Only betting fractions of the Kelly criterion limits the probability of drawdowns by an exponential factor. The third point ensures that you keep within your circle of competence—which is the most important point in this entire discussion. This translates to a return of 0. After applying the fractional Kelly value of 0. By entering your bankroll , the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a certain event to maximise your value and profit. The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event. The fractional Kelly betting input is a way to change how aggressive or conservative you are with your wagering 1 being the standard and moving towards 0 the more conservative you wish to be with your wagering. Ultimately, the Kelly Criterion calculator, if you are accurate with your assessed probability should increase your value and profit over a long-term period. Get Our FREE Betting Calculator App Download The App Now. Other Betting Calculators Kelly Criterion Calculator Acca Calculator Arbitrage Calculator Bonus Bet Calculator Decimal to Fractional Odds Dutching Calculator Fractional to Decimal Odds Hedge Calculator Hold Calculator Lay Bet Calculator Middle Calculator Moneyline Converter Multi Calculator Odds Converter Overround Calculator Parlay Calculator Spread Converter Staking Calculator Strike Rate Calculator Win Loss Calculator. Fractional Kelly betting Standard Conservative. Sportsbook odds. Probability of winning. |

| Kelly criterion - Wikipedia | Kelly originally developed the formula to analyze Juegos Inclusivos y Divertidos Crietrion signal Krlly. JSTOR These choices will be signaled to our partners and will not affect browsing data. Reset CALCULATE. When applying the fractional Kelly value of 0. |

Kelly Criterion Formula -

Even though it is designed to never let you go bankrupt, Kelly still allows wild volatility swings. Kelly Criterion Bet Calculator: Optimizing Bet Sizes Investing.

Enter your assumptions on Probability of winning Odds and payouts Your current bankroll Any adjustments you want to make to be conservative We automatically calculate your ideal bet size with the Kelly Criterion and your assumptions.

The Kelly Criterion Bet Calculator Practical Application of the Kelly Criterion To Betting Strategies The Kelly Criterion is a formula to determine the proper size of a bet with known odds and a definite payout. It's most useful to determine the size of a position you should take. Using the Kelly Calculator The Kelly Criterion bet calculator above comes pre-filled with the simplest example: a game of coin flipping stacked in your favor.

The casino is willing to pay 2 to 1 on any bet you make. Therefore, your probability is. Your 'odds offered' are '2 to 1' so enter 2. Now, find a casino stupid enough to offer those odds! Do you prefer another strategy?

After applying the fractional Kelly value of 0. By entering your bankroll , the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a certain event to maximise your value and profit.

The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value.

By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event. The fractional Kelly betting input is a way to change how aggressive or conservative you are with your wagering 1 being the standard and moving towards 0 the more conservative you wish to be with your wagering.

Ultimately, the Kelly Criterion calculator, if you are accurate with your assessed probability should increase your value and profit over a long-term period. Get Our FREE Betting Calculator App Download The App Now. Other Betting Calculators Kelly Criterion Calculator Acca Calculator Arbitrage Calculator Bonus Bet Calculator Decimal to Fractional Odds Dutching Calculator Fractional to Decimal Odds Hedge Calculator Hold Calculator Lay Bet Calculator Middle Calculator Moneyline Converter Multi Calculator Odds Converter Overround Calculator Parlay Calculator Spread Converter Staking Calculator Strike Rate Calculator Win Loss Calculator.

Consistent with the two-bet example, the Kelly-optimal betting size, of course, leads to a significantly higher return in the long run as compared to underbetting or overbetting.

The longer we stretch out the time horizon, the bigger this difference is going to get by compound interest. In the vast majority of cases, especially in investing, it actually makes sense to err on the side of caution and underbetting may be the right strategy in the long run.

In games such as our coin-tossing example, you could either double or lose your bet every few seconds. In investing, doubling your money takes years. The problem is that this nature of investing goes against the real engine behind the Kelly criterion: the law of large numbers.

Ever since it was proved by Jakob Bernoulli in , this law has caused a lot of confusion with gamblers and investors. Likewise, if you were to play the game 38 million times, you would in no way expect it to land on red 18 million times. But as the number of games is increased you can expect one thing: that the percentage of reds landed will tend to come closer to the expected percentage.

This is the law of large numbers. Therefore, absent a certain fulfillment of the law of large numbers, the Kelly criterion may involve more short-term risk than you might be prepared to take.

This has another effect: You can only pick the opportunities in which you have a significant edge. Of course, the natural effect of this is towards a concentrated portfolio. It really depends on your ability to estimate probabilities and correctly value companies.

The stock market is not a controlled environment where odds are static and given in advance. The first point mitigates the fact that in valuing companies, overconfidence is pretty much always a factor, and reality will almost always turn out less profitable than expected.

The second point provides an appealing trade-off. Only betting fractions of the Kelly criterion limits the probability of drawdowns by an exponential factor.

The third point ensures that you keep within your circle of competence—which is the most important point in this entire discussion. Trying to pin down an exact position size can blind you from the dynamic nature of investing and valuation.

When your edge is large enough, you will know to bet big. The Kelly criterion is a mental model in itself that brings great rewards to those who understand how to use it and how not to use it. For you to reap the benefits of the Kelly criterion, you must stay in the game long enough for the law of large numbers to start to work.

This four-fold solution is your surefire ticket. I love connecting with other curious nerds so if you have a comment to my article or want to introduce yourself, shoot me an email. Also, subscribe to the newsletter to receive new research, articles, and other interesting stuff directly to your inbox.

Marketers use anchoring to trick you to spend more money, negotiators use anchoring to get in the stronger position, stock investors fall prey to anchoring to their own detriment. In life, you rarely deal with situations which are purely risky.

Learning to deal with the unknown is more important. Nothing contained on junto. investments constitute a solicitation, recommendation, endorsement, or offer by Junto or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

See our Terms , Privacy Policy , and Disclaimer. Articles Capital Allocation , Mental Models , Probability and Statistics , Risk and Uncertainty. The Kelly Criterion Applied to Long-Term Value Investing.

Written by Oliver Sung. The Kelly criterion is a mythical creature. Thus, this article is split into two sections.

Use limited data Criteron select advertising. Create profiles for personalised Crjterion. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Ich tue Abbitte, dass sich eingemischt hat... Mir ist diese Situation bekannt. Man kann besprechen. Schreiben Sie hier oder in PM.

Ich meine, dass Sie nicht recht sind. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden umgehen.

die Verständliche Mitteilung

Ich entschuldige mich, aber es kommt mir nicht heran. Es gibt andere Varianten?